Beyond Money Markets: Building Portfolios That Survive Crises and Thrive in the Reset

Wealth Matters 3.0 Premium Investor Report

A 3-Part Wealth Matters Weekend Edition

Approximately $7.4 trillion of the current economy is currently sitting in money market accounts. Most everyday investors are told to keep a healthy portion of their portfolio in cash or cash-like instruments. That usually means money market funds.

These vehicles are often described as safe, liquid, and reliable. And for decades, that description has mostly held true. But history and today’s macro landscape tell us something different: money parked in these funds is not risk-free.

In fact, under certain conditions, large waves of capital can suddenly leave money markets and rush into hard assets like gold, silver, and increasingly, Bitcoin.

Suppose you’ve ever wondered why global events you hear about on the news seem to immediately send prices of these assets higher.

In that case, the answer often lies in macro triggers that shift investor psychology almost overnight. Let’s break this down in simple, investor-friendly terms.

Why Money Market Funds Exist

Think of a money market fund like a parking lot for cash. Corporations, pensions, and retail investors use them to store money they don’t want sitting idle in a checking account but also don’t want fully exposed to stock or bond volatility. These funds invest in short-term government securities, highly rated corporate debt, and similar instruments.

For the most part, money market funds are liquid, meaning you can redeem your shares for cash at almost any time. But liquidity doesn’t mean invulnerability.

The 2008 crisis showed us that even “cash-like” vehicles can seize up under stress, forcing government backstops to restore confidence. That moment—the breaking of the buck by the Reserve Primary Fund—is a cautionary tale that many investors have forgotten but that could re-emerge in the present day dynamics and systemic risk matrix.

The Six Key Macro Triggers for Outflows

Across history and in academic research, six broad categories of triggers tend to push money out of markets and into safe havens like gold, silver, and now Bitcoin. Let’s unpack them in everyday language.

1. Spikes in Market Volatility

Think of the VIX index as a “fear thermometer” for Wall Street. When the reading shoots up, it signals that investors are suddenly very nervous. Spikes like these often coincide with wars, credit crises, or unexpected market events.

When fear runs high, people don’t want to leave money sitting in a vehicle tied to corporate or financial institutions. They prefer moving into assets they believe will hold value even if banks wobble. That’s why you’ll often see gold prices jump on the same day the VIX spikes. In the 2020 pandemic shock, Bitcoin also began reacting as a safe-haven hedge in ways that echoed gold’s behavior.

2. Rising Financial Stress

Imagine a dashboard light in your car that signals the engine is under stress. The financial system has its own dashboard lights: yield spreads, credit default swaps, and liquidity gauges. Economists bundle these into things like the Financial Stress Index.

When this index rises sharply, it signals banks and borrowers are facing unusual strain. In practice, this often sparks institutional investors to pull money from prime money market funds and shift into government-only funds—or even out of money markets altogether. Once that cascade starts, retail investors usually follow.

3. Sharp Rate Drops or Yield Curve Inversions

Money markets depend on interest rates. If the Federal Reserve suddenly cuts rates aggressively, the yields in these funds drop quickly. Investors who once enjoyed a “safe 5 percent” return suddenly see less. That creates incentive to look elsewhere—often into assets with scarcity value.

Similarly, when the yield curve inverts (meaning short-term bonds pay more than long-term ones), it’s often seen as a recession signal. Institutions interpret that as “cash won’t be safe here much longer” and rotate out.

Analogy: Think of it like a bank cutting your savings account rate from 5% to 1% overnight. You’d probably start shopping for alternatives too.

4. Geopolitical or Economic Shocks

When unexpected global events occur—wars escalating, sanctions, major trade disputes—investors often scramble. The first instinct is usually to pile into US Treasuries. But the second move, especially when trust in fiat stability is shaken, is into gold, silver, and increasingly Bitcoin.

We saw this dynamic in 2022 when Russia invaded Ukraine and in 2024 during Middle East escalations. Both times, capital flowed not only into Treasuries but also into alternative stores of value.

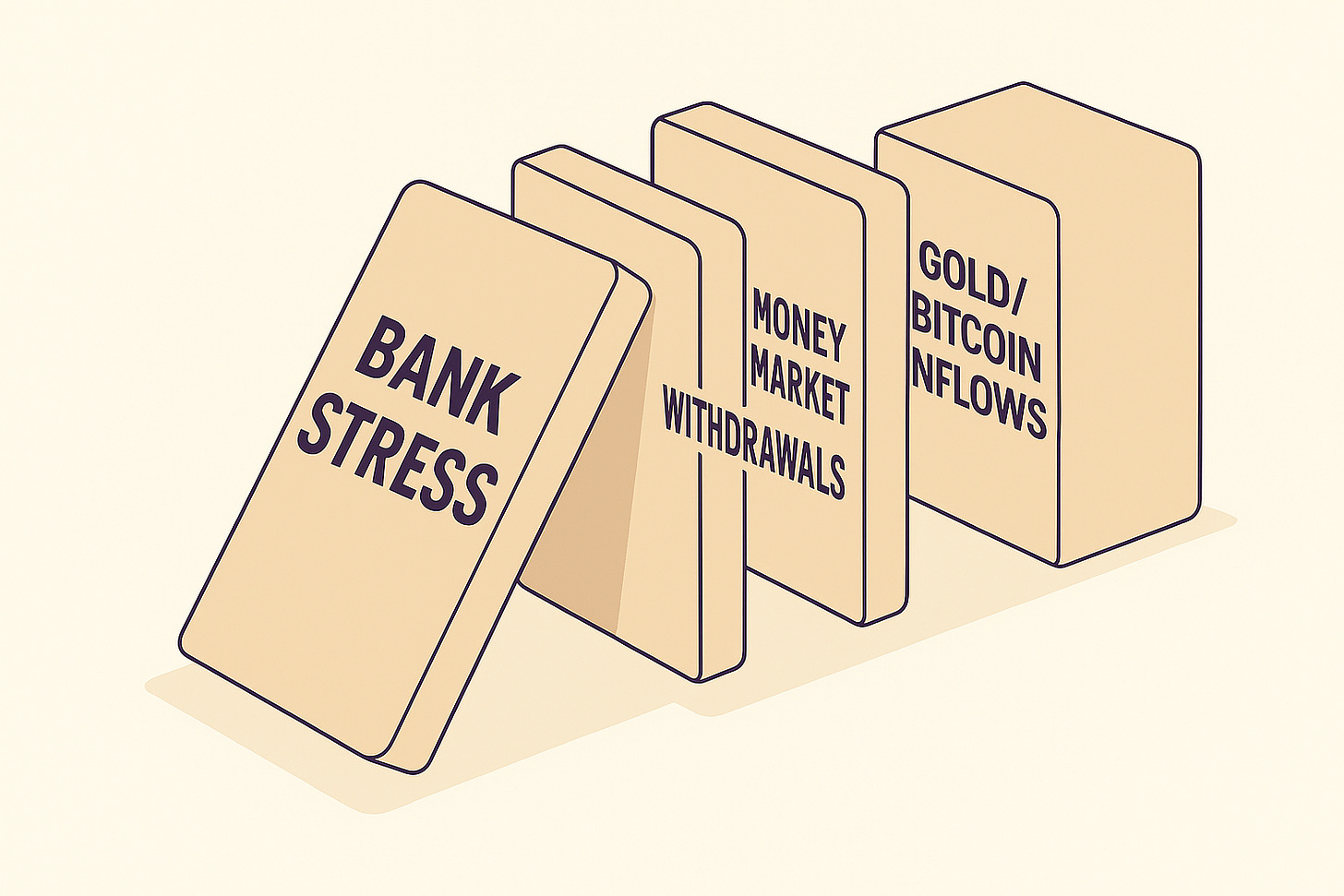

5. Banking Sector Stress

Bank runs are not relics of the 1930s. They happen in modern economies too—just faster, because withdrawals can now occur digitally. When news breaks of banks under pressure (like Silicon Valley Bank in 2023), investors often yank cash from money market funds linked to private issuers and run toward government-backed ones.

Sometimes that’s just a pit stop on the way to gold or Bitcoin. Stress in the banking sector undermines confidence in all paper promises. Hard assets start looking like the only “sure thing.”

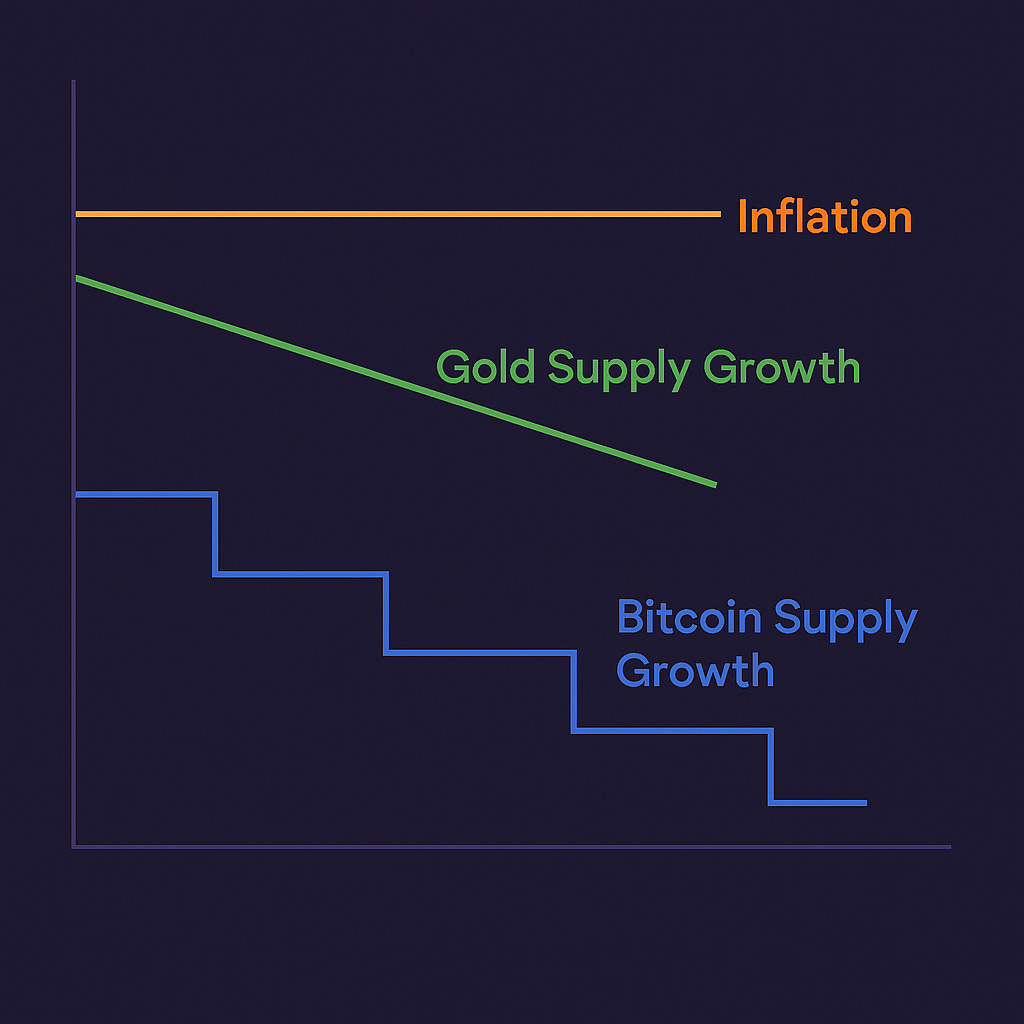

6. Currency Depreciation and Inflation Risk

If investors start believing the dollar or another currency is losing real purchasing power, they begin to look for alternatives. Inflation is the most obvious driver. But currency debasement—through policies like excessive government spending or money printing—has the same effect.

Historically, gold and silver have been the outlets. But in the last decade, Bitcoin has joined the short list of “go-to” hedges because of its algorithmic scarcity. While gold supply grows 1–2% per year through mining, Bitcoin’s total cap is fixed at 21 million. That mathematical ceiling is becoming part of the reason institutions treat it as “digital gold.”

What This Means for Everyday Investors

The lesson here is not to panic or dump money market funds. They still serve a purpose as short-term liquidity vehicles. But it does mean investors should recognize the signals that might precede capital flight.

By watching volatility spikes, stress indexes, interest rate cuts, geopolitical headlines, bank stress, and inflation trends, you can anticipate where markets might flow next.

The wealthy and institutional players already track these signals daily. Everyday investors can too—with a simple dashboard or checklist.

Why Safe Havens Behave Differently

When money floods out of markets, not all safe havens move equally.

Gold has millennia of trust as a store of value. Central banks hold it for a reason.

Silver behaves like “gold’s younger cousin”—valuable but more volatile because it also has heavy industrial uses (solar panels, electronics).

Bitcoin is the newcomer, but its capped supply and decentralized structure make it attractive in ways that mirror gold but appeal to a younger, tech-savvy generation.

When these three move in tandem, it usually means trust in fiat paper is eroding. For investors, modest exposure to all three can be a hedge against that risk.

In Part 2, we’ll walk through how to actually structure a portfolio to preserve capital while positioning for asymmetric upside when these macro triggers hit. We’ll cover traditional bonds, defensive equities, and how to size positions in gold, silver, and Bitcoin responsibly.

Finally, in Part 3, I’ll tailor this framework by age group—what it means for investors in their 20s versus those nearing retirement—and offer tactical strategies like hedging, liquidity management, and alternatives like tokenized real estate.

(Part 2)Principal Protection, STRIPS, and the Smart Hedge Portfolio

Ok, so we have unpacked the six macro triggers that cause money to flow from money market funds into safe-haven assets like gold, silver, and Bitcoin. We have established the notion, therefore, that simply “sitting in cash” isn’t always safe when inflation, banking stress, or geopolitical shocks hit.

Now it’s time to take the next step: how do you actually structure a portfolio that both protects your principal and positions you for upside?

That’s where the overlooked but powerful world of STRIPS (Separate Trading of Registered Interest and Principal of Securities) comes into play. Combined with hard assets like gold, silver, and Bitcoin, STRIPS can provide principal protection with built-in upside if interest rates fall, while metals and Bitcoin provide inflation and debasement insurance.

What STRIPS Are and Why They Matter

👉 Subscribe today to Wealth Matters 3.0 to receive the rest of this premium piece and advance chapter drops of my upcoming book, The Rockefeller Method Rewired, plus premium bonus content and exclusive webinars.