Chapter 1: A Tale of Two Fortunes

Excerpted from The Rockefeller Method Rewired (Pre-release)

I. Introduction: The Fate of Fortunes

Picture a sun-washed terrace in upstate New York, where four generations of Rockefellers gather to share a meal, the young ones laughing, the elders swapping stories of charitable ventures and boardrooms, and the family matriarch leading a prayer before the meal. In that moment, you see not just a wealthy dynasty, but an institution of values, unity, and purpose.

Contrast that scene with the faded grandeur of a Vanderbilt mansion—now a public museum, the gilded ballrooms echoing only with the footsteps of tourists, a monument to what once was, but can never be again.

These mental images are more than historical trivia. They tell the story of what separates a fortune that endures from a fortune that vanishes. They provoke a central question for every person, no matter their starting net worth:

How can we make sure the fruits of our labor and the values that created them last beyond our lifetime?

In this opening chapter, we will explore the Rockefeller and Vanderbilt family stories not just as biographical sketches but as archetypes of two opposing philosophies: the Rockefeller commitment to stewardship, governance, and values-driven wealth, and the Vanderbilt focus on conquest, consumption, and social display. Through their comparison, you will discover the frameworks, mindsets, and structures that determine whether family wealth becomes a generational blessing or a cautionary tale. The entirety of this book’s value to you then will be predicated on which of those paths you choose to embark upon.

II. Gilded Age Titans: The Builders

The Gilded Age was an era of unstoppable ambition in America. Railroads were laid, oil was pumped, and fortunes were minted almost overnight. Two men in particular stood out among the giants of that age.

Cornelius Vanderbilt, born in 1794, rose from modest beginnings on Staten Island to become the king of American shipping and then the railroad empire. His single-minded determination, iron will, and appetite for consolidation built one of the greatest personal fortunes ever assembled in the 19th century[^1][^2]. Vanderbilt’s empire reshaped the American transportation grid and made him a household name by the time of his death in 1877.

On the other side stood John D. Rockefeller, born in 1839. By 1863, Rockefeller had invested in his first oil refinery in Cleveland, Ohio, seeing what most others could not: oil was going to be the fuel of modern industry[^3][^4]. Through methodical, disciplined practices, Rockefeller mastered the consolidation of every link in the oil supply chain, driving costs down and controlling distribution in ways that seemed almost superhuman. By 1872, Standard Oil had become the largest oil refiner in the world, and Rockefeller was on his way to becoming the wealthiest human in history.

These two men built their fortunes under the same broad economic tailwinds of industrial expansion, but the real difference emerged not in how they built their wealth, but in how they treated it.

III. Diverging Philosophies: Making vs. Keeping Wealth

Cornelius Vanderbilt created more wealth than nearly anyone else in his day. Yet when historians look back, they often note that he left behind no lasting legacy plan, no institutional framework, and no structured family governance[^1][^5]. Vanderbilt’s children and grandchildren inherited enormous sums but also the complete freedom to do as they pleased with no family constitution to guide them. They built grand homes, hosted lavish parties, and fought social battles for prominence in New York’s upper crust, but little of that money was intentionally preserved.

The Vanderbilts prized social position, prestige, and visible excess. Their palatial estates from Fifth Avenue to Newport testified to a value system rooted in consumption and status. But that system proved hollow without a sustaining philosophy, and over time the fortune fractured, then crumbled.

By contrast, Rockefeller saw wealth not as a trophy but as a trust. He believed he was a steward of resources God had granted, to be managed for the benefit of others—family, church, society, and the world[^6][^7]. He focused early on organizing his family, drafting governance structures, establishing mission statements, and even teaching his children personal finance skills. His value system was anchored in faith, frugality, long-term vision, and a sense of higher responsibility.

This difference between possessing wealth and stewarding wealth is the core divide between Rockefeller and Vanderbilt, and it is the hinge on which generational legacies rise or fall.

IV. The Mechanics of Legacy: Structures and Systems

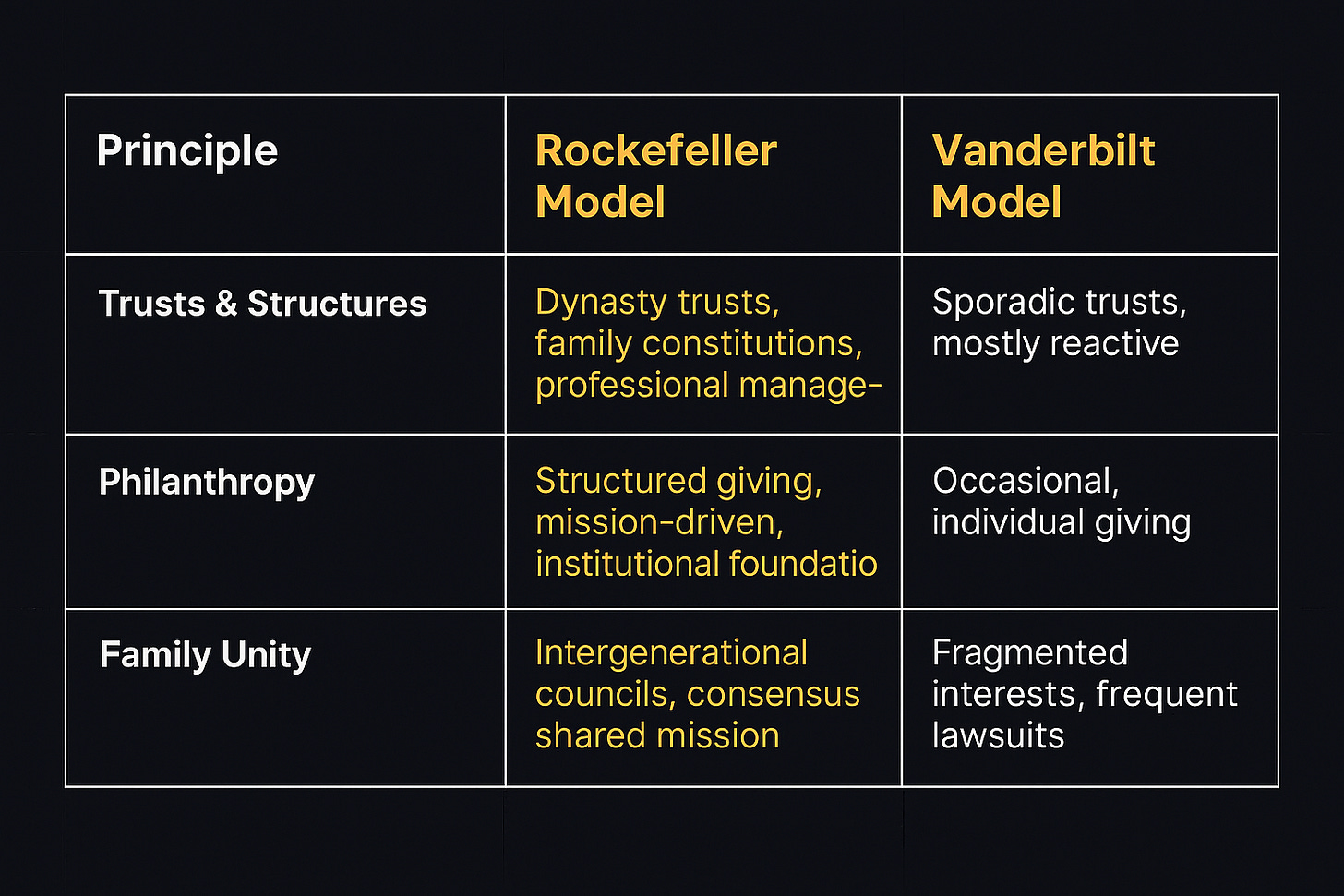

The story of these families becomes even clearer when you study the structures they built (or failed to build). Let’s break it down.

Rockefeller’s legal structures and carefully designed family governance protected the family assets through the Great Depression, world wars, and countless financial panics. The dynasty trusts built in 1934 and 1952 provided a systematic way to manage distributions, prevent family conflict, and maintain growth[^3]. His approach emphasized process over personality—rules and frameworks outlast any single individual.

Vanderbilt’s framework, if you could even call it that, was a patchwork of sporadic trusts and improvised inheritances. There was no unified mission, no cross-generational education, and no mechanism to hold heirs accountable to any higher purpose. Predictably, as the wealth spread thinner among more heirs, its cohesion crumbled.

V. The Role of Faith and Values

John D. Rockefeller’s approach to money was inseparable from his Christian convictions. Raised by a devout Baptist mother in the revivalist fervor of the Second Great Awakening, Rockefeller absorbed a sense of stewardship from childhood. His mother, Eliza Davison Rockefeller, instilled in him that wealth was a divine trust, never a personal entitlement. From the very beginning of his working life, he tithed ten percent of every paycheck, no matter how small, to his church[^2].

This was more than a personal act of devotion; it was the foundation of a philosophy that guided every choice he made about money. Rockefeller believed, profoundly, that God had granted him the gift of making money, and that this gift carried a holy obligation to use it for the betterment of society[^3]. As he wrote, “I believe the power to make money is a gift from God… to be developed and used to the best of our ability for the good of mankind.”

This faith-centered worldview shaped the entire Rockefeller blueprint. His pastor once told him to “make as much money as you can, then give away as much as you can,” advice Rockefeller described as “the financial plan of my life”[^3].

Rockefeller saw no contradiction between his aggressive business tactics and his Christian ethics, provided that the ultimate purpose of wealth was to uplift, to heal, and to build.

He practiced what some called “messianic self-righteousness,” combining strict adherence to Biblical discipline with total confidence that his actions were morally correct[^3]. Daily Bible readings, prayer meetings, and family devotions structured his personal life, while a systematic, almost spiritual discipline guided his investments. In both arenas, Rockefeller applied the same sense of divine order.

His wife, Laura Spelman Rockefeller, played an equally critical role in weaving Christian values into the family’s wealth culture. Laura, from an abolitionist family that had operated a station on the Underground Railroad, brought a fierce sense of moral mission into their marriage[^7][^8]. She shaped the family’s earliest philanthropic programs, including the funding of Spelman College, a landmark in the education of African American women[^10][^12].

Laura’s influence extended into family governance. She insisted that the children live frugally, work hard, and carry Christian service into their daily choices. The children were raised with Friday night prayers, daily Bible study, and verse recitations. She believed, as did John, that wealth must serve a higher calling and could only be preserved through disciplined stewardship[^13].

This culture of faith and duty was not abstract; it was codified into the Rockefeller family structures, from trust agreements to mission statements, and taught to every heir. Faith became the engine that made Rockefeller’s systems not just legal or financial but deeply moral, giving them the power to endure.

VI. The Power and Pitfalls of Planning

Rockefeller’s Christian beliefs helped him build planning frameworks far beyond what was common among Gilded Age tycoons. For him, estate planning was not a luxury; it was a spiritual mandate. He wanted to protect the family from sudden reversals, legal challenges, and the moral erosion that unstructured wealth often brings.

By 1934, the first major Rockefeller Family Trust was established, with a second wave of structures emerging by 1952[^15][^16]. These trusts were not only vehicles for tax efficiency; they were designed to enforce active engagement by heirs. Family members needed to show they could serve responsibly before receiving any significant benefit. This was a way to keep faith, stewardship, and purpose alive across generations.

The Rockefeller system went even further, using professional management to reinforce Christian discipline. Rockefeller Financial Services, created with specialized arms for money management, venture capital, insurance, and risk oversight, made sure that no single family member could blow through their share without oversight[^16].

Regular family meetings became rituals of shared purpose. Sometimes involving more than 200 cousins, these gatherings functioned like modern synods, reaffirming the family mission, voting on governance updates, and hearing reports from charitable projects[^19][^20]. For Rockefeller, this was the expression of the Biblical model of community and covenant: everyone had a voice, but everyone had a duty to the mission.

Compare this to the Vanderbilts, who made only sporadic attempts at estate planning, with no unified vision or spiritual foundation. Their enormous resources fractured in a generation, broken apart by social climbing, reckless spending, and infighting[^5].

The Rockefeller structures were far more than legal tools; they were a moral firewall. A purpose-built system that demanded engagement and reaffirmed Christian values at every transition.

VII. Generational Transitions: Stewardship vs. Squandering

The Rockefeller children were not left to figure out stewardship alone. Laura Rockefeller personally homeschooled them in scripture and the duties of Christian service, while John modeled frugality, work ethic, and an almost liturgical commitment to prayer. Their only son, John D. Rockefeller Jr., absorbed these lessons deeply[^22]. Junior devoted his entire adult life to expanding the Rockefeller mission, giving away hundreds of millions to projects that advanced “human welfare and international, interfaith, and interracial concepts”[^24].

Junior’s theology adapted to the 20th century. While remaining Baptist, he supported interdenominational and secular projects that pursued the Christian ideal of human uplift[^23]. He sponsored the restoration of Colonial Williamsburg, helped launch the United Nations headquarters, and advanced causes in global health and education.

Image Source:https://rockarch.org/assets/img/rockefellerfamilytree_adaptation.png

This sense of faith-guided responsibility persisted into the third generation. Each of Junior’s five sons built distinct but connected pillars of the family legacy:

John D. Rockefeller III: Founded the Asia Society, advancing cross-cultural understanding, echoing the Christian mission of reconciliation[^25][^26].

Nelson Rockefeller: Governor, Vice President, and art patron, demonstrating public service as Christian stewardship[^27].

Laurance Rockefeller: Expanded land conservation, reinforcing Christian “creation care”[^27].

Winthrop Rockefeller: Transformed Arkansas with racial equity and economic development initiatives[^28][^29].

David Rockefeller: Guided Chase Manhattan while championing philanthropy alongside his wife Margaret, who pioneered coastal conservation[^30].

Meanwhile, Rockefeller women advanced the family’s stewardship mission with equal strength. Abby Aldrich Rockefeller, Junior’s wife, co-founded the Museum of Modern Art to democratize access to creativity[^31][^32]. Blanchette Rockefeller elevated modern art’s respect in American culture, while Margaret Rockefeller preserved farmland and protected coastlines through landmark conservation trusts[^33][^34].

Each of these stories shows that Rockefeller descendants saw faith not just as personal belief, but as a principle of engagement, inspiring public and philanthropic leadership. They approached wealth as a tool to build human flourishing, consistent with the Biblical call to serve.

Roadmap for the Rest of This Book

You can continue finishing Chatper 1 shortly, but here is how you will transform these lessons each week into a practical, modern blueprint chapter by chapter

Chapter 2: The Rockefeller Blueprint Decoded

Break down the timeless frameworks Rockefeller built: dynasty trusts, family governance councils, philanthropic structures, and a mission-driven view of money as a tool for human good.

Chapter 3: Macroeconomic Mastery for the Modern Steward

Learn how to read the signals of global growth, interest rates, trade wars, and resource shifts — so you can position your family wealth like a Rockefeller would, for the next century of opportunity and risk.

Chapter 4: Technological Innovation as a Strategic Advantage

Harness exponential tools: Bitcoin, AI, blockchain, and quantum encryption. Learn how to apply these innovations to strengthen your family portfolio and secure its governance systems.

Chapter 5: Geopolitical Resilience

Explore how the Rockefellers hedged against war, social change, and policy swings — and apply these methods to modern challenges from U.S.-China tensions to resource nationalism and currency shifts.

Chapter 6: The Monetary System — From Gold to Bitcoin

See how Rockefeller mastered the gold-backed economy of his era, and how you can replicate that mastery today with Bitcoin, stablecoins, and other modern monetary instruments.

Chapter 7: Building Strategic Reserves

Establish your family’s “strategic reserves” using a mix of hard assets, programmatic life insurance, annuities, and bitcoin-backed reserves — modernizing the Rockefeller method for your risk profile.

Chapter 8: Trust Engineering and DAOs

Go beyond paper-based trusts to engineer programmable family governance with smart contracts and DAOs (decentralized autonomous organizations) that update in real time as the world changes.

Chapter 9: Automating Wealth Transfer

Deploy AI, smart contracts, and digital inheritance tools to future-proof your family’s transfer of knowledge, resources, and mission — reducing disputes and maximizing impact.

Chapter 10: Privacy, Security, and Cyber Resilience

Master advanced cyber and personal security to protect your wealth against deepfakes, social engineering, and other modern threats, with lessons straight from Rockefeller’s “family security office” mindset.

Chapter 11: Aligning Advisors and Personal AI

Build your own “virtual family office,” combining licensed professionals with personal AI assistants, so you get consistent strategic advice with next-level efficiency and insights.

Chapter 12: Dynamic Family Constitutions

Learn how to codify your family’s values, mission, and governance processes into a living, updatable constitution that keeps heirs aligned across multiple generations.

Chapter 13: Adaptive Risk Management

Build an insurance and risk buffer that can handle systemic shocks — pandemics, climate, policy shifts — by merging parametric policies, reinsurance pools, and Bitcoin-based liquidity.

Chapter 14: Educating the Next Generation

Design education programs, family learning retreats, and mission-driven gatherings that embed stewardship principles so your legacy survives culture shifts and generational differences.

Chapter 15: Writing Your Family’s Enduring Story

Bring it all together in a legacy narrative that ensures your story — like Rockefeller’s — inspires future branches of your family tree and benefits society for generations to come.

Before You Dive In…

You are unlocking more than a book — you are holding a 150-year-old roadmap, modernized for a new era of exponential change, geopolitical complexity, and technological acceleration. Rockefeller faced a world transformed by railroads and oil; you face one reshaped by AI, Bitcoin, and global connectivity. But the principles remain timeless.

If you build your family’s plan like a Rockefeller, you will stand the test of time. And that is what this book and community is here to help you do.

To unlock the rest of Chapter 1 and receive the next 15 chapters each week as bonus premium content, leading up to the October 28th book launch, just upgrade your subscription to paid today!

Now let’s return to Chapter 1 Continued…