Chapter 3: Macroeconomic Mastery for the Modern Steward

Pre-release excerpt from my forthcoming book The Rockefeller Method Rewired

Introduction: Why Macro Matters More Than Ever

Rockefeller’s genius wasn’t just in accumulating wealth — it was in anticipating change. He didn’t wait to be blindsided by market crashes, wars, or policy shifts. He studied the tides, not just the waves. He designed a financial life that could bend with the cycles without breaking.

Macroeconomics is often taught as the science of aggregates: GDP growth, national unemployment figures, inflation rates, monetary policy, and global trade balances. That’s all technically true. But if you're a wealth steward, an entrepreneur, a family office leader, or even just a serious investor navigating the fog of today’s markets, that textbook definition falls short.

Because for you, macroeconomics is more than a set of charts and models. It’s your early warning system. It’s your radar.

Understanding macroeconomic dynamics helps you discern the terrain beneath your feet — and most importantly, what’s coming over the horizon. You don’t have to predict the future with perfect accuracy, but you do need to anticipate when conditions are shifting. And you need to know how to adjust when they do.

When you internalize macro, you start moving differently:

You conserve capital before everyone else panics.

You deploy capital when everyone else is frozen.

You rotate from one asset class to another with quiet confidence.

You sidestep policy shocks instead of being blindsided.

You understand when to go liquid and when to go long.

Most of the risk in wealth building doesn’t come from the markets themselves — it comes from moving out of sync with the macro cycle.

This stuff is not theoretical. Macroeconomics influences the cost of your money (interest rates), the real value of your returns (inflation), the profit margins of your business (labor and capital costs), the valuation of your real estate (supply, demand, and credit flows), and even your exit strategy timeline (tax regimes and policy incentives). That’s real life. That’s real money.

And the most dangerous thing you can do is ignore it because it seems abstract or “not your lane.”

If you’re serious about multigenerational wealth — or simply keeping what you’ve worked hard to earn — macroeconomics is your operating system. Everything you build sits on top of it. You can have the best trust structure, the best legal team, the best portfolio — but if you’re trying to build on a macroeconomic fault line without understanding how to read the seismic signals, you’re exposed.

John D. Rockefeller didn’t just build empires. He timed them.

He built in oil because energy demand was structurally rising. He divested early from assets under regulatory pressure. He strategically expanded in moments of panic, knowing those were the times when the market was on sale. He built when credit was cheap and scaled back when it tightened. He read the political winds and used his philanthropy to stabilize his influence. In short, he played the whole board, not just his corner of it.

To follow that model in the 2020s and 2030s, you don’t need to be a PhD economist. But you do need to develop macro awareness. You need to learn to see the signals, not just the noise.

Because today, wealth isn’t just built by effort. It’s preserved by rhythm.

As a lifelong hobbyist drummer, I can tell you that macroeconomics is the beat you need to hear when it comes to the music of money.

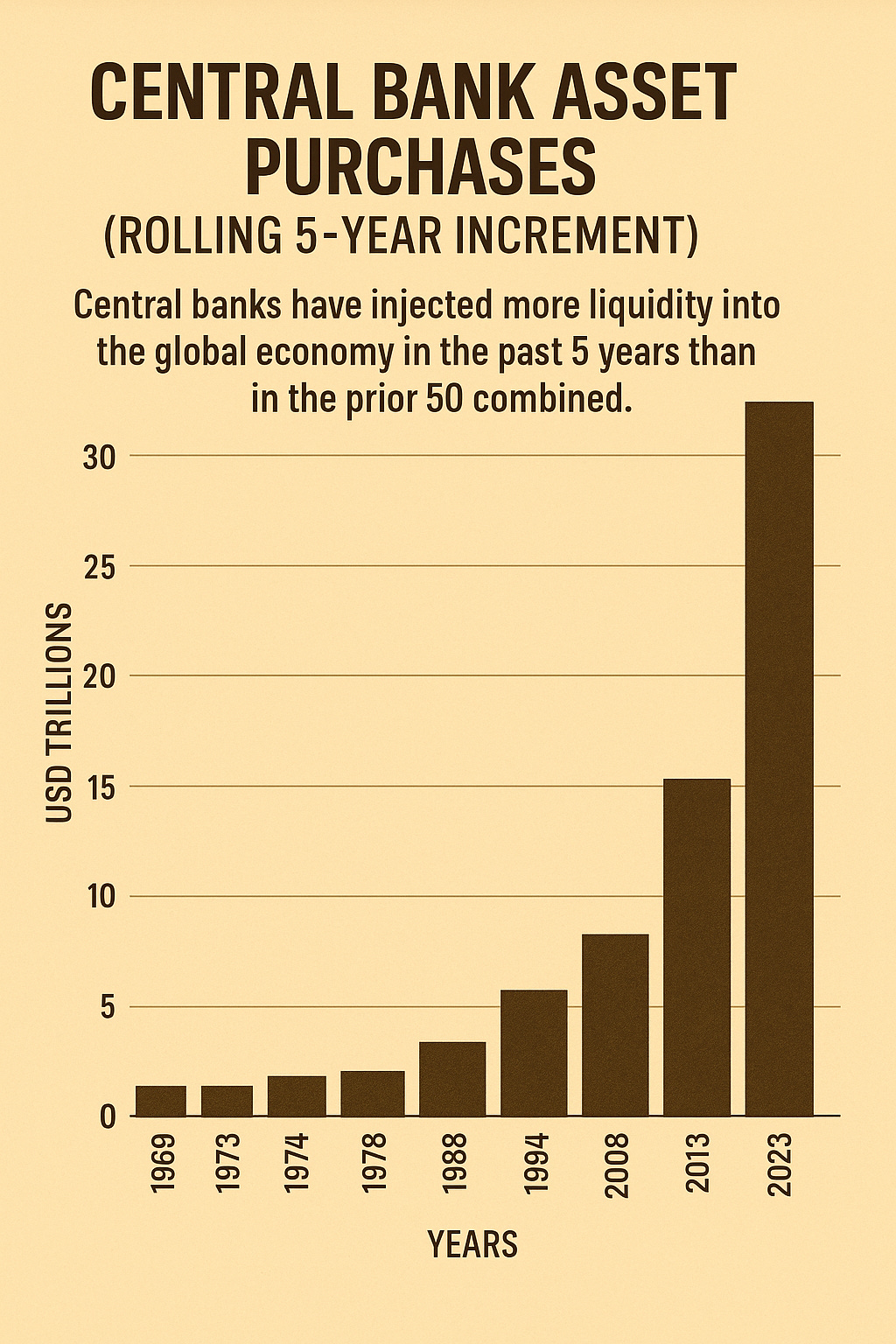

You, the modern steward of wealth, are now navigating the most volatile macroeconomic environment since the 1940s. That’s not hyperbole — that’s data. Central banks have injected more liquidity into the global economy in the past five years than in the prior fifty years combined[^1].

Figure 1.0

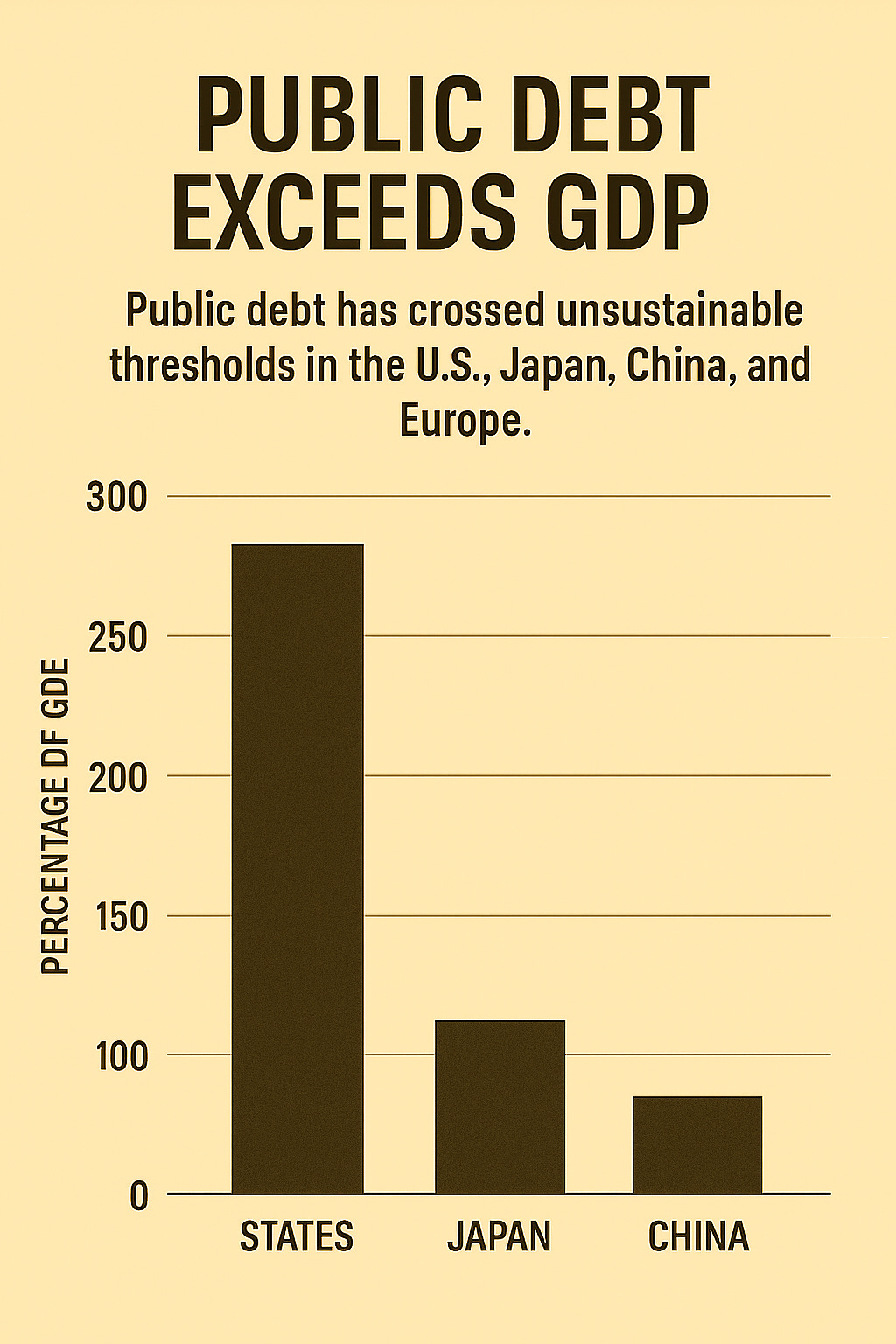

Public debt has crossed unsustainable thresholds in the U.S., Japan, China, and Europe[^2]. Demographic cliffs are reshaping labor and housing. Energy geopolitics, inflation, and AI productivity shocks are happening all at once.

Figure 1.2

If you don't master macroeconomic signals today, you're not just uninformed — you're exposed.

Rockefeller understood that wealth preservation is not passive; it’s strategic. And that strategy starts with understanding the terrain and economic playing field.

This chapter is your map and legend.

Foundations: What Is Macroeconomics and Why Should Stewards Care?

Macroeconomics is the study of the big picture: national output, employment, interest rates, inflation, government policy, and international trade. But for you — the family steward, entrepreneur, or investor — macroeconomics is really about how the system is moving beneath your feet.

It’s your radar.

It tells you when to conserve, when to risk, when to rotate assets, and when to stay still.

It influences:

Real estate values

Cost of capital

Business margins

Asset class correlations

Tax policy shifts

Retirement timelines

Rockefeller thrived because he could read the weather. He could see political winds and economic clouds gathering and adjusted accordingly. If you want to preserve wealth through the 2020s and 2030s, this must become part of your rhythm, too.

The Four Forces Shaping the Next 25 Years

Let’s simplify the chaos. The macroeconomic terrain ahead isn’t random—it’s a system shaped by four interlocking mega-forces. Each force is a wave. You can fight them, ignore them, or learn to surf them. This section is about helping you become a macroeconomic surfer, not a victim of tides you didn’t see coming.

1. Debt and Demographic Drag

If you want a clear lens into the future, follow two intertwined trends: aging populations and mounting public debt. Across Western nations and developed economies, the ratio of retirees to working-age individuals is soaring. For every retiree withdrawing from the system, fewer workers are contributing to it. In Japan, this drag is already acute. Europe and the U.S. are right behind.

But here’s the real squeeze: governments made promises—pensions, Medicare, subsidies, social security—based on old demographic assumptions. Now, those assumptions are collapsing. To meet obligations, governments are borrowing more. As a result, debt-to-GDP ratios have crossed 100% in most developed economies. In the U.S., we’re approaching levels last seen during World War II, only this time without the productivity boom of a wartime manufacturing economy.

The implications are sobering:

Tax Burden Increases – Governments will seek revenue wherever they can: tariffs, cross-border remittances, wealth taxes, inheritance taxes, unrealized gains—all are being floated.

Currency Debasement – Inflation becomes the politically expedient path. A weaker dollar can “inflate away” the debt over time, at the cost of your purchasing power.

Private Sector Crowding Out – As governments borrow more, they absorb capital that could have gone into innovation or infrastructure. The result is slower economic growth.

As investor and macro strategist Lyn Alden puts it in her seminal work, Broken Money, we’ve shifted from an era of Monetary Dominance—where central banks control outcomes—to an era of Fiscal Dominance, where governments will spend no matter what. The central bank’s role now is to support those fiscal mandates, even if it means keeping interest rates below inflation for years.

For you as a steward, this means thinking in real terms. What matters is not just nominal returns, but how much purchasing power your capital retains and how well your assets keep up with policy-driven inflation.

2. De-Dollarization and Currency Volatility

The U.S. dollar has been the global reserve currency since Bretton Woods in 1944. That position is still intact, but the edges are fraying.

Across the world, countries are growing wary of overdependence on the dollar system. China, Russia, Brazil, Saudi Arabia, and other BRICS+ members are creating new trade agreements, launching central bank digital currencies (CBDCs), and stockpiling gold and commodities. Even U.S. allies are hedging their bets.

The implications are enormous:

Diversification of Reserves – Central banks are reducing their dollar exposure. Gold is rising as a neutral reserve asset. Bitcoin is now being considered as a digital counterpart to gold.

Rise of Bilateral Trade Settlements – Countries are bypassing the dollar for trade. China and Russia now settle oil in yuan. India and UAE are trading in rupees and dirhams.

Currency Instability – The dollar may not collapse, but it may become more volatile. With multiple systems coexisting—USD, yuan, crypto rails—the playing field is fragmenting.

For families and investors, this means rethinking the very foundation of portfolio construction. If your entire net worth is in USD-denominated assets, you're overly exposed to geopolitical risk and fiscal mismanagement. More sophisticated stewards are now holding:

Hard Assets like gold, silver, and real estate

Digital Hard Assets like Bitcoin

Strategic Cash in multiple jurisdictions or stablecoins

Commodity exposure via energy, agriculture, and metals

You don’t need to exit the system to win. You need to hedge against its eventual volatility and position ahead of the institutional players in the next one simultaneously.

3. Technological Disruption

We are now in the early innings of the Fifth Industrial Revolution—and this one moves faster than all previous ones combined. If the last century was defined by oil, steel, and electricity, this century belongs to computing, bandwidth, energy, and intelligence.

The fusion of artificial intelligence, decentralized finance, robotics, quantum computing, and tokenized assets will reset how capital moves, how labor is quantified, how businesses operate, and how trust is enforced.

Think of it like 100 years ago, when we democratized access to electricity, and every home that wanted it could then afford it? We never built structures (commercial or residential) the same again. When Ford made automobiles affordable to everyone, the horse and buggy were relegated to a novelty overnight. The same is happening now to business models in every industry with the convergence of generative AI (affordable at scale), connectivity (more people with internet connectivity than clean running water across the globe), and money that moves at the speed of light 24/7/365 at fractions of the cost of the SWIFT system. We will never build businesses or work the same way again.

This is the inevitable. This is your window to end-run smart money and sovereign wealth funds, while the majority of others are slower to wake up or fast asleep and overwhelmed by the cheap dopamine of their social media feeds.

One of my partners Rav in our www.BlockCity.Fi portfolio company at ATOMIQ said it best the week of July 13, 2025, in the Figure below

Figure 1.3

Key shifts underway: