Is Bitcoin Broken or Just Growing Up? The Silent Signals Behind the Latest Surge

Unpacking What Mainstream Financial Media Will Not on Why This All-Time High in Bitcoin Is Structurally Different and What it Means to You.

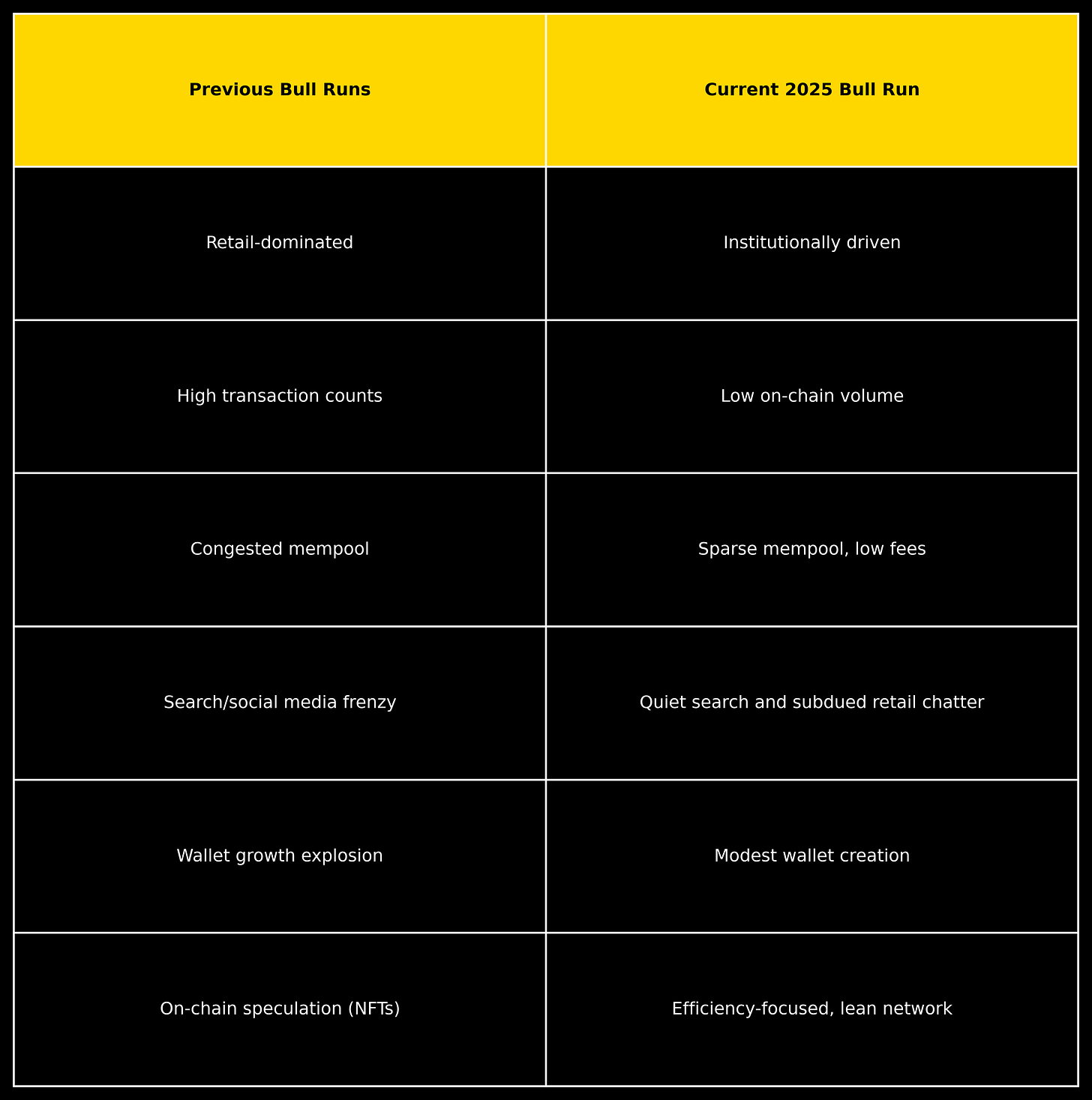

Bitcoin has reached new all-time highs, yet the underlying network tells a very different story than in previous cycles. In past bull markets, price surges were accompanied by overwhelming on-chain activity: mempools packed with pending transactions, sky-high fees, and millions of small retail trades recorded on the blockchain. This time, that pattern is absent. Transaction counts are subdued, mempools remain uncongested, and fees are modest. This disconnect between price and network behavior signals a significant shift in Bitcoin’s market structure—one with major implications for investors.

Understanding the Basics: Miners and Mempools

To appreciate what’s changing, it helps to revisit two foundational components of the Bitcoin network:

Miners are the operators who validate transactions and secure the blockchain. They assemble pending transactions into blocks, solving complex mathematical problems in return for Bitcoin rewards and user-paid fees.

The mempool (short for "memory pool") is the staging area for unconfirmed transactions. It acts like a queue: when the network is busy, the queue grows, and users must offer higher fees to get their transaction processed quickly.

During past price rallies, mempools would swell and fees would spike as small-scale retail investors flooded the network. Today, even as prices rise, network traffic remains unusually quiet.

What’s Behind the Quiet Network?

1) Institutional Inflows

The most important factor behind the subdued network activity is the institutionalization of Bitcoin. Large financial institutions now drive most of the volume, with transactions exceeding $100,000 making up nearly 90% of all activity on the blockchain. These transactions are fewer in number but much higher in value.

Institutions often use custodial solutions or prime brokers, where internal transfers are settled off-chain. As a result, the actual number of on-chain transactions declines even as the amount of capital moving through the ecosystem increases.

2) Retail Sidelined

Retail activity has dropped sharply compared to previous cycles. In 2017 and 2021, retail-sized transactions (under $1,000) accounted for over 30% of network activity. Today, that figure hovers around 11%.

Several factors contribute to this decline:

Many retail investors feel they have missed the opportunity after watching prices rise.

Spot Bitcoin ETFs now offer easier exposure without the need to interact with wallets or manage private keys.

Economic pressures—including elevated credit card APRs and tight household budgets—reduce the ability to speculate.

3) Network Efficiency

Improvements in blockchain infrastructure have also reduced transaction counts. Exchanges now batch thousands of withdrawals into single transactions. Layer 2 solutions like the Lightning Network move activity off-chain. And the conclusion of the 2023–2024 NFT and memecoin boom has returned activity to more normalized levels.

4) Macroeconomic Constraints

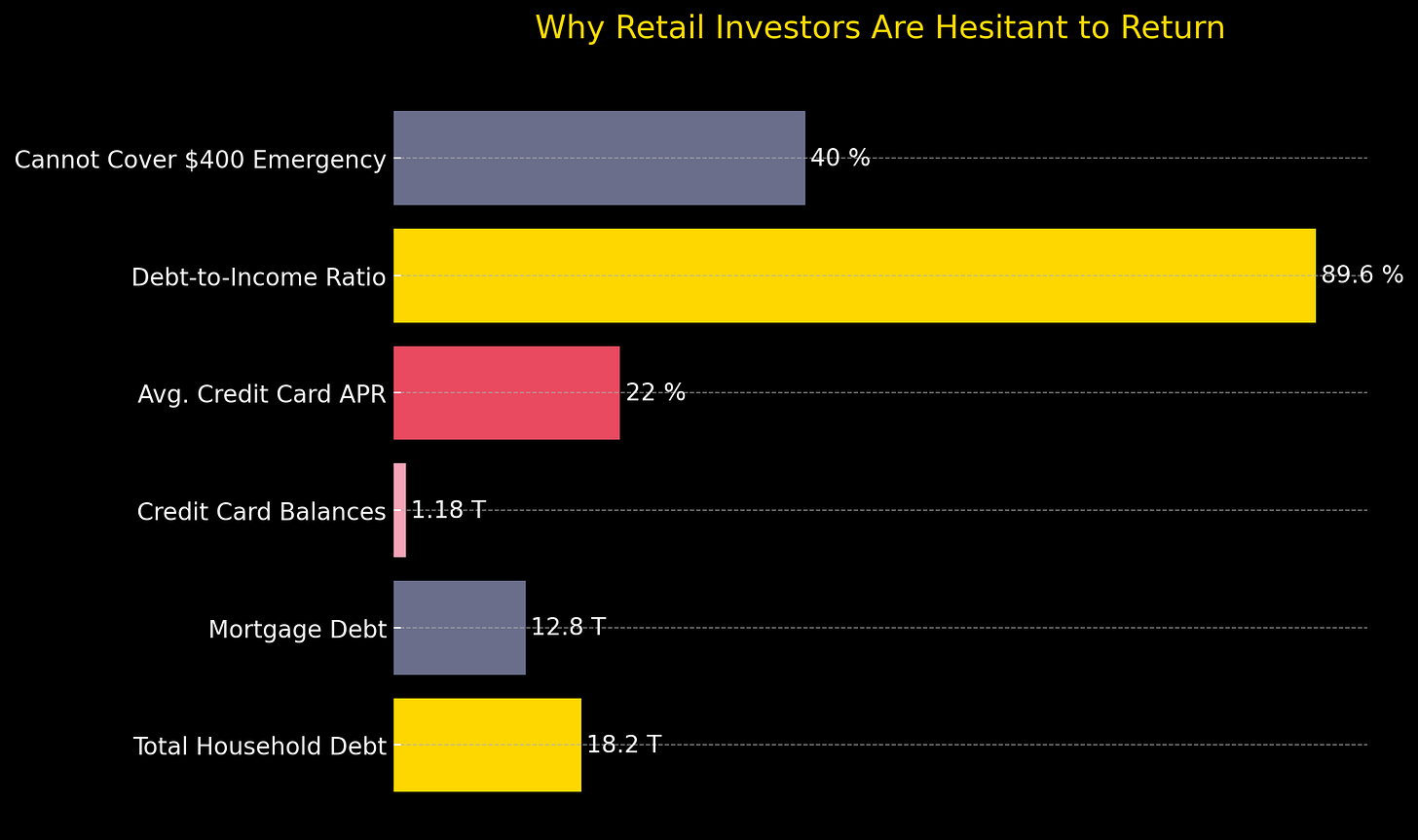

Economic conditions further explain why retail has not returned in force. U.S. household debt reached $18.2 trillion in Q1 2025, with mortgage debt accounting for over $12.8 trillion. Credit card balances have grown to $1.18 trillion, and average APRs exceed 22%.

Even though the household debt-to-income ratio has dropped to a generational low of 89.6%, nearly 40% of Americans still report they could not cover a $400 emergency expense. This financial fragility suppresses retail appetite for speculative investments, including Bitcoin.

Comparing This Bull Run to Prior Cycles

Subscribe to unlock the rest:

Discover how Bitcoin’s radical transparency gives you an edge over traditional finance, and what to watch for as institutions and retail investors shape the next wave. Includes tactical strategy, macro signals, and risk mitigation frameworks for the modern investor.