There Are No Easy A’s: Why the Student Debt Crisis Will Reshape Capital Flows, Retirement Security, and the Future of Wealth

Wealth Matters 3.0 Student Debt Defaults Research Brief: How the Student Loan Crisis Is Rewiring Capital Flows, Collapsing Trust, and Fracturing the Investment Landscape Forever.

When it comes to solving the problem of student debt defaults, the systemic risks their policy coverage has created, and the polarizing political and generational viewpoints, only one thing is clear: There are zero easy answers, and this impacts every investor whether they realize it or not.

TL:DR Summary

The student loan crisis is no longer a slow-moving issue hidden in the personal finance corners of American life. It is now a front-and-center macroeconomic event with systemic risk, real political consequence, and generational fault lines that will reshape the investment landscape across the next two decades.

More than 43 million Americans owe student debt. Over half are now either delinquent or in forbearance, following the end of the federal payment pause. These numbers are staggering—but the consequences are even more significant.

This crisis is rewiring how capital flows across housing, credit markets, crypto, and alternatives. It is shifting cultural psychology and eroding trust in institutions. And here’s the part almost no one is talking about: while freeing this generation from their debt burden may be necessary, the consequences of such a move will quietly show up in the retirement accounts, pension funds, and insurance portfolios of an entirely different class of investors—who don’t even realize they’re holding the bag.

There are no easy or painless solutions. But there are clear insights to act on. And if you're paying attention, this crisis reveals exactly where wealth is being restructured, and how to position yourself ahead of the turning tide.

How We Got Here: A Brief History of the Trap

The student debt machine was engineered over four decades. Prior to the 1980s, higher education was heavily subsidized and student debt was minimal. But as public funding declined and tuition costs exploded, loans filled the gap.

In 2005, bankruptcy law changed. Student loans became almost completely non-dischargeable—even in most bankruptcy cases. This one policy turned education debt into a permanent burden. Borrowers could not walk away. Lenders had a guaranteed asset. The securitization market saw opportunity.

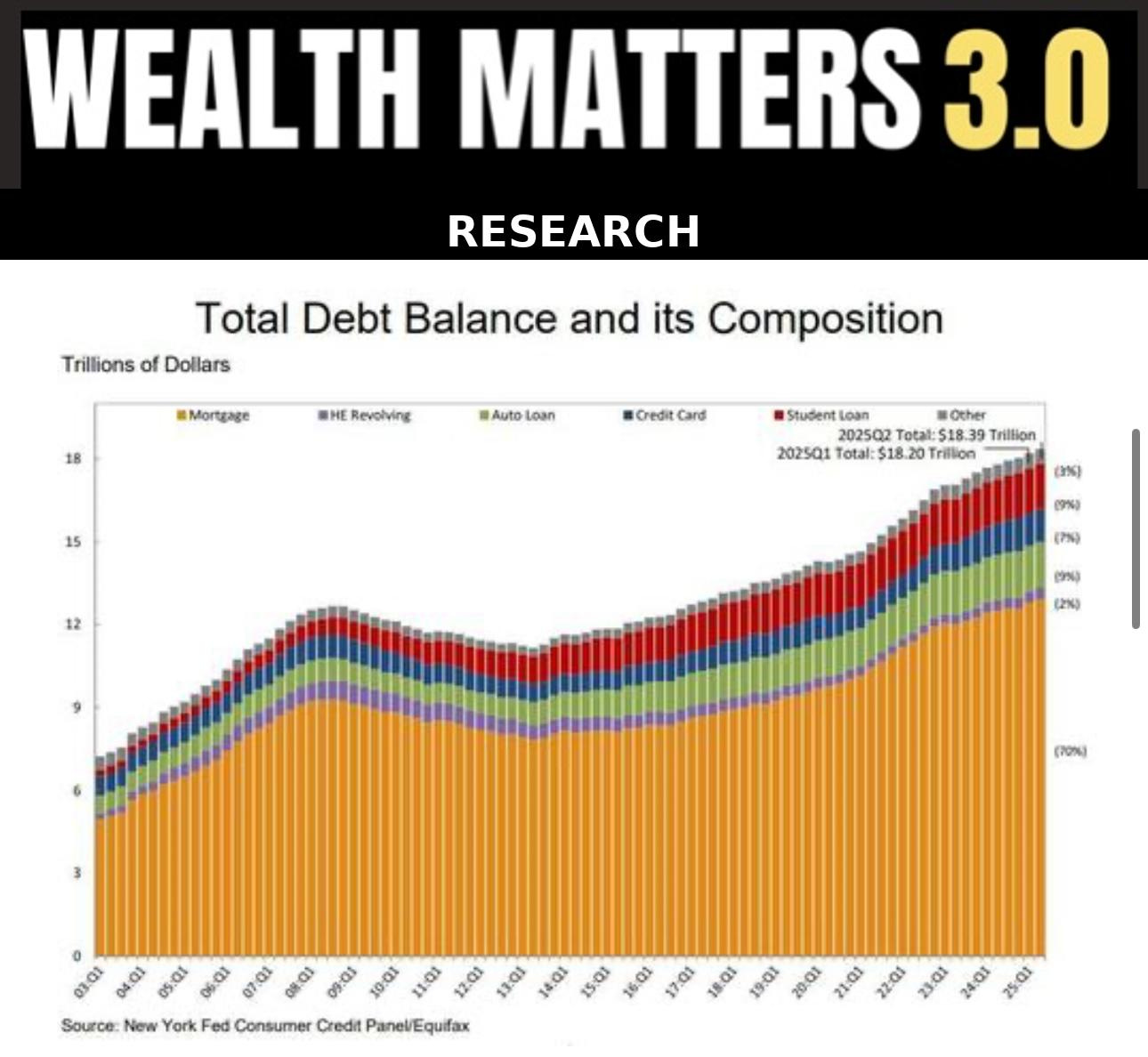

As the 2008 financial crisis hit, millions went back to school as a form of refuge, driving the student loan market to triple in size. Today, outstanding balances exceed $1.77 trillion.

When COVID hit, the government paused payments for three years. That pause ended in 2023, and now the default wave is building.

The Current Data Snapshot (2025)

Total student loan debt in the U.S.: $1.77 trillion

Borrowers delinquent or in forbearance post-CARES pause: 52%

Average monthly payment: $393

Borrowers over age 50 still repaying loans: 7 million+

Share of loans securitized into asset-backed products: ~25%

Those numbers are INSANElY troubling. This is not just a problem for young adults. It is a deeply embedded drag on upward mobility, wealth creation, and economic resilience across two generations.

The Feedback Loop That Keeps Getting Worse

Student debt doesn’t exist in isolation. It compounds into a negative feedback loop:

Debt burdens suppress home buying

That reduces demand and tax revenue in cities

Public services and infrastructure decline

Economic opportunity shrinks

More people borrow in hopes of escaping the trap

And the cycle continues.

For millions, the burden becomes normalized. The goal shifts from paying it off to just surviving with it. And that psychological shift has massive implications for capital markets.

A Generation’s Beliefs Are Changing

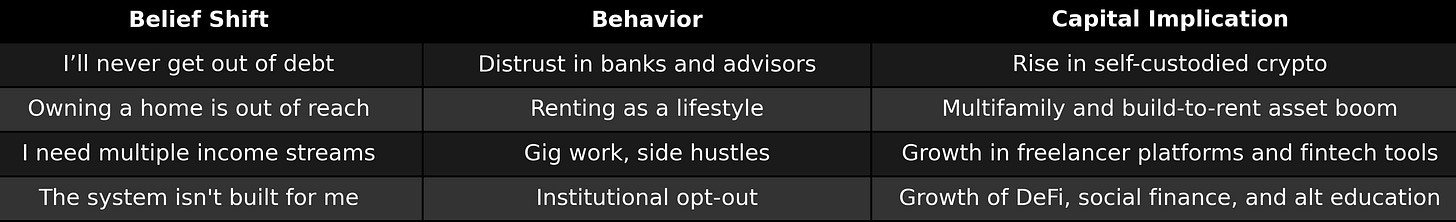

Student debt isn’t just a financial liability. It’s become a psychological operating system. And the beliefs it's producing are now shaping investor behavior, asset preference, and risk appetite:

Belief Shift: "I’ll never get out of debt."

Behavior & Capital Implication 1: Distrust in banks and advisors, Rise in self-custodied crypto.

Belief Shift: "Owning a home is out of reach.

Behavior & Capital Implication: Renting as a lifestyle, Multifamily and build-to-rent asset boom

Belief Shift: "I need multiple income streams."

Behavior & Capital Implication: Gig work, side hustles, growth in freelancer platforms, and fintech tools.

Belief Shift: "The system isn't built for me."

Behavior & Capital Implication: Institutional opt-out, growth of DeFi, social finance, and alternative AI-powered self-education and reskilling.

This is not rebellion. It is a rational response to a broken contract.

How This Affects Different Investor Profiles

Retail investors

If you’re carrying debt, building wealth the traditional way may not be viable. That means leaning into alternative frameworks—covered calls, staking income, fractional ownership, private lending—and exploring wealth outside the confines of mainstream systems.

High-net-worth families and family offices

The next generation of wealth inheritors will not follow the same paths. Prepare estate planning vehicles with flexibility: multi-decade trusts, Bitcoin treasuries, income overlays, and sovereignty-focused wealth preservation strategies.

General partners and fund managers

Expect slower capital inflows from LPs with personal debt burdens. Yield-driven co-investments, cash-flow alignment, and alternative collateral structures will help attract capital from Gen X and Millennials in this environment.

Real estate investors

This is the decade of workforce housing. Focus on multifamily units in secondary cities, build-to-rent projects, and suburban sprawl fueled by debt-constrained migration. Ownership demand will remain flat, but rental demand will surge.

Crypto-native investors

You are positioned well, but must focus on infrastructure and usability. Platforms that enable “sovereign savings” in BTC or cash-flowing crypto will win the loyalty of a generation that no longer trusts legacy rails.

The Hidden Risk in Student Loan Securitization

Roughly one in four (25%) student loans has been securitized into asset-backed securities (SLABS) and sold into institutional portfolios. This includes:

State and municipal pension funds

Insurance company portfolios

Target-date retirement funds

University endowments

These products were purchased as “safe” yield. But they rely on borrowers paying for 20 to 30 years. As delinquencies rise or forgiveness policies emerge, these bonds begin to underperform. Credit downgrades follow. Redemptions begin. The capital cushion starts to erode.

Who Pays for the Jubilee?

If the government wipes out or restructures student debt, someone still pays. And that someone is most likely: