The Cantillon Effect: Why Money Creation Breeds Inequality, Nihilism, & Meme Manias

Wealth Matters Weekend Edition:

Bitcoin Is the Last Chance for Everyday People ~Chris J Snook

Happy Friday!

Money isn’t neutral—it’s directional. It doesn’t just appear and float evenly across society. Instead, new money ripples outward like shockwaves, shaping who wins, who loses, and who feels like the game itself is rigged. This centuries-old principle is known as the Cantillon Effect. And in our modern fiat age, it has created conditions of widening inequality, generational frustration, and the strange cultural phenomenon of meme stock manias.

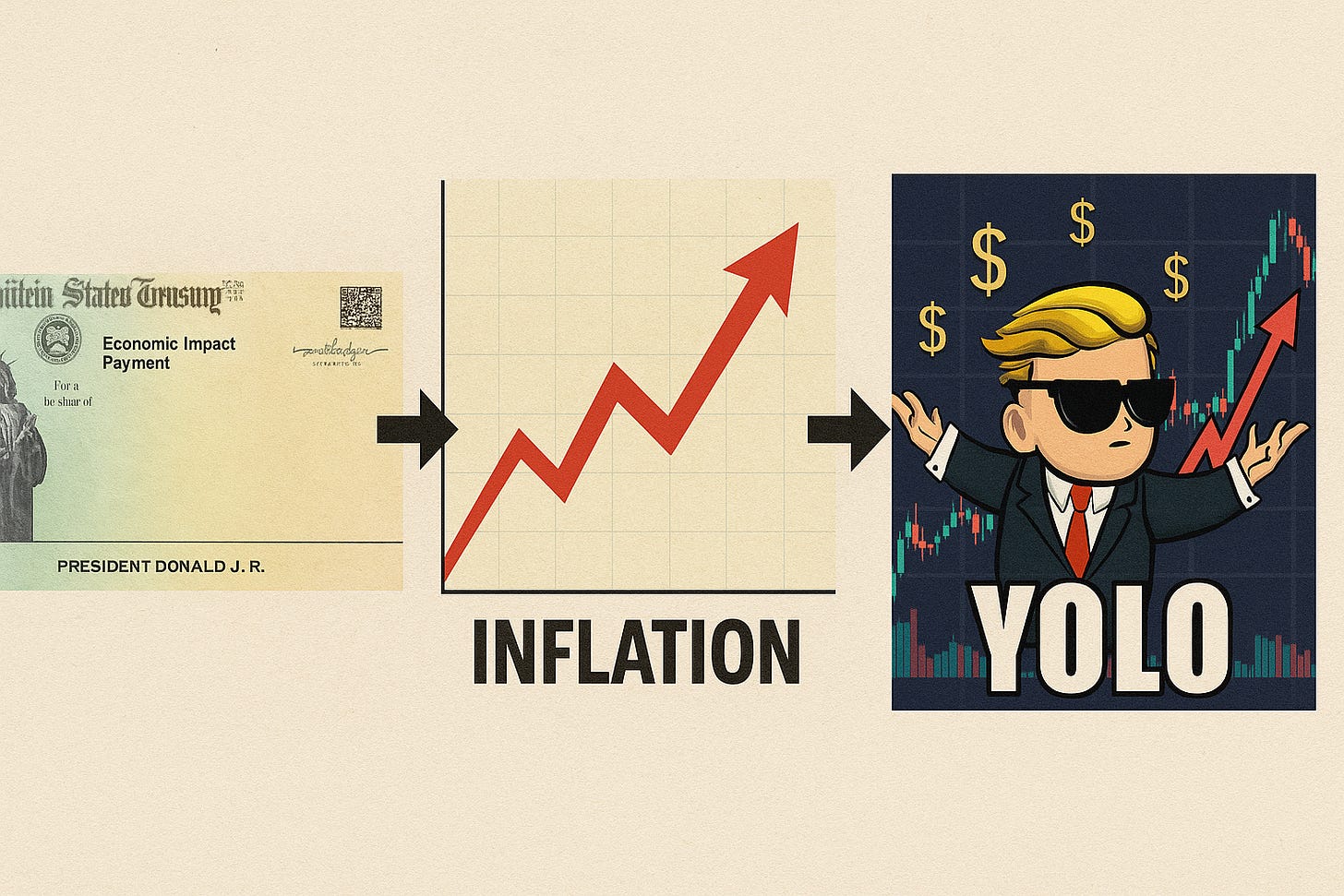

We’re watching the final chapters of fiat debauchery unfold as we live through the final 8-10 years of this Fourth Turning in America and the world. From stimulus checks that vanished into higher prices, to stocks pumped more by Discord memes than fundamentals, we are living in an era of financial nihilism.

In the middle of this chaos, Bitcoin stands apart, despite being mostly misunderstood by 99% of investors or the population. It is not controlled by central banks, political cycles, or bailouts. It is permissionless and anti-fragile. It’s the first real chance every day people have to participate in money creation on fair terms, but before they feel compelled to know why that matters, they must contextually understand the Cantillon Effect.

Understanding the Cantillon Effect

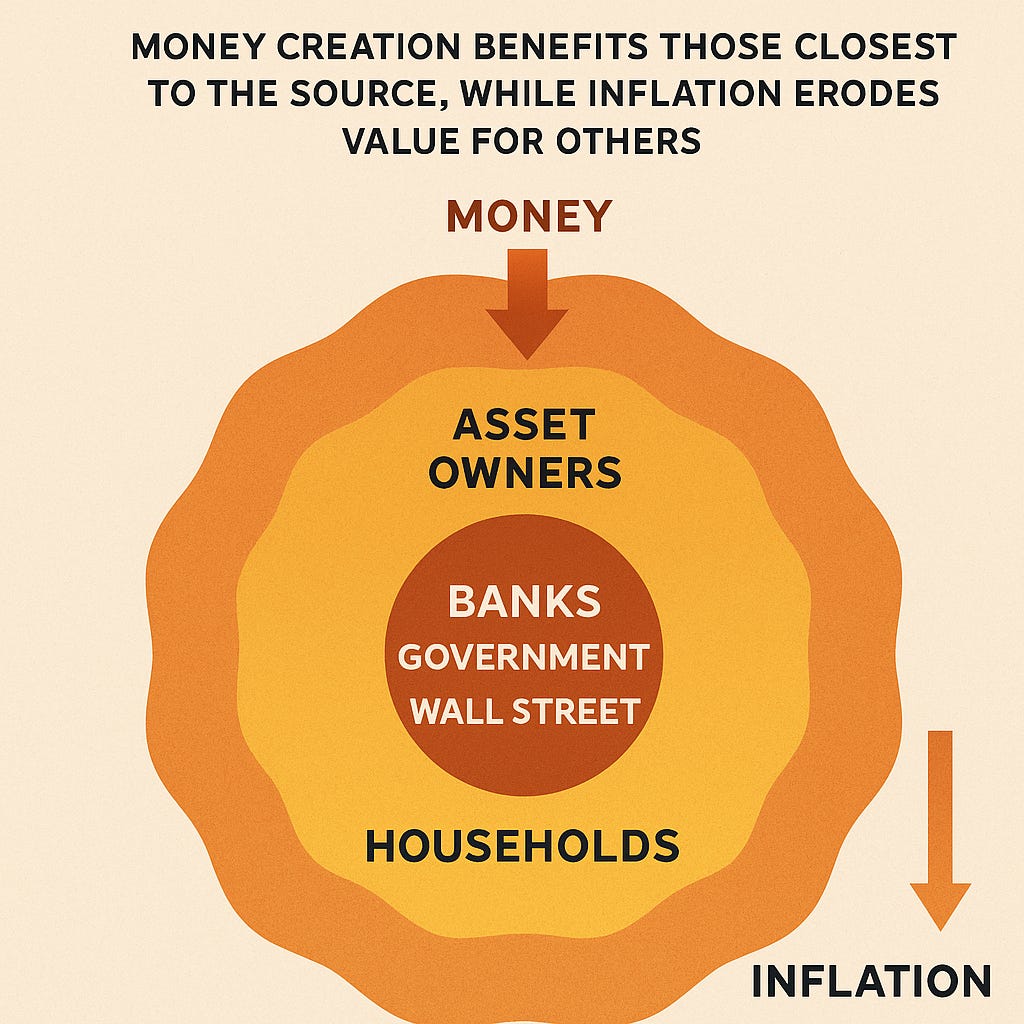

Richard Cantillon, writing in the 18th century, noticed something simple but profound: new money doesn’t help everyone equally. Those closest to where it enters the system—banks, governments, corporations—benefit first. They get to buy assets and deploy capital before prices adjust. By the time inflation filters through to workers and savers, the extra cash is worth less.

That’s why asset owners keep pulling away from wage earners. It’s why quantitative easing inflated stocks and real estate values while median wages stayed flat. The top 0.1% surf the monetary wave, while the bottom half of society gets left behind, watching the ladder of opportunity pulled further out of reach.

Who Benefits Most: Proximity to Power

Every crisis has reinforced this pattern. In 2008, it was the banks. In 2020, it was the airlines, the mega-corporations, and the tech giants who were “too big to fail.” Meanwhile, small businesses, renters, and savers saw higher costs and fewer options.

This is the Cantillon Effect in practice: a split circuit economy where insiders get the first pass at new capital, and the rest of us get what’s left after inflation and asset bubbles. Even well-meaning policies, such as the PPP loans or stimulus checks during the pandemic, only paper over the widening gap.

Why the Cantillon Effect Hurts Everyday People

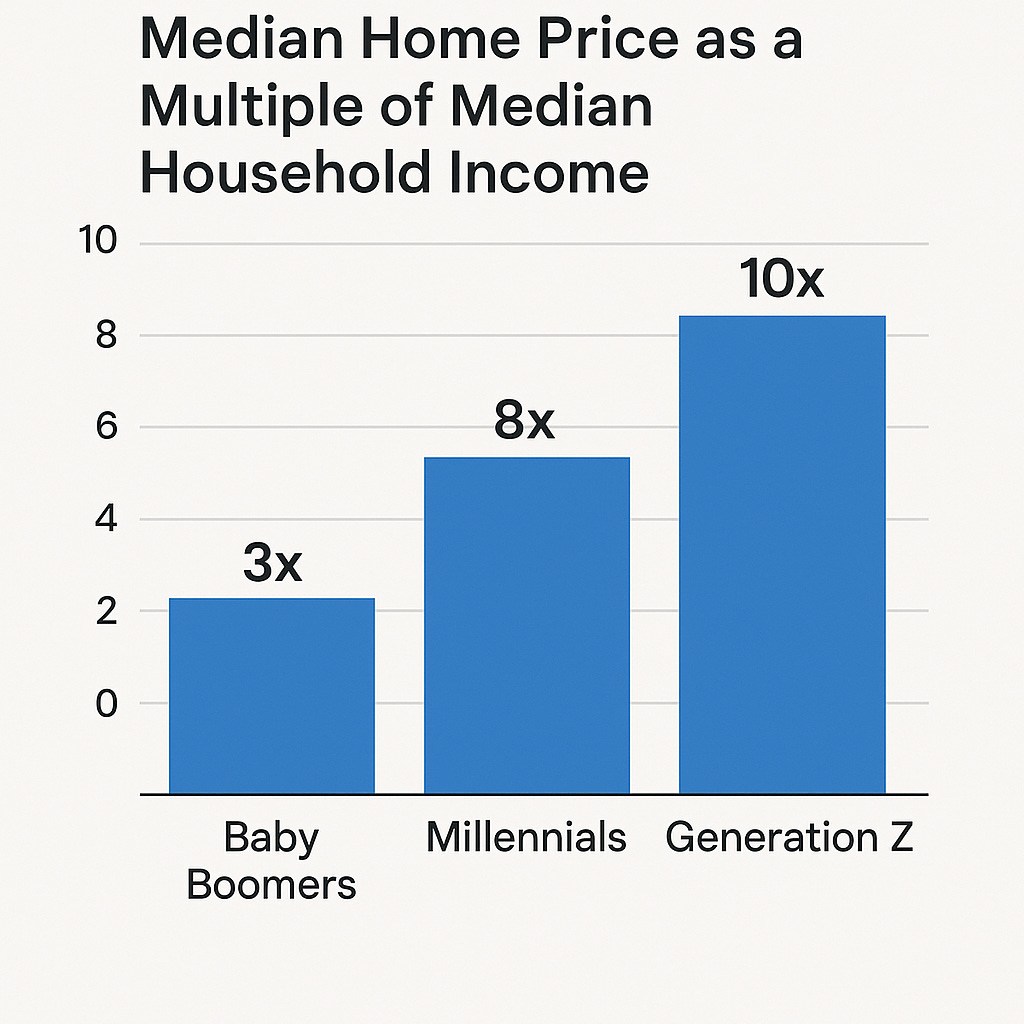

For the average household, inflation is a regressive tax. It eats savings. It makes housing unaffordable. It stretches intergenerational inequality—young families can’t buy homes their parents afforded easily. Trust in institutions erodes as the gap between lived reality and official data grows wider.

Hard Data: The Numbers Don’t Lie

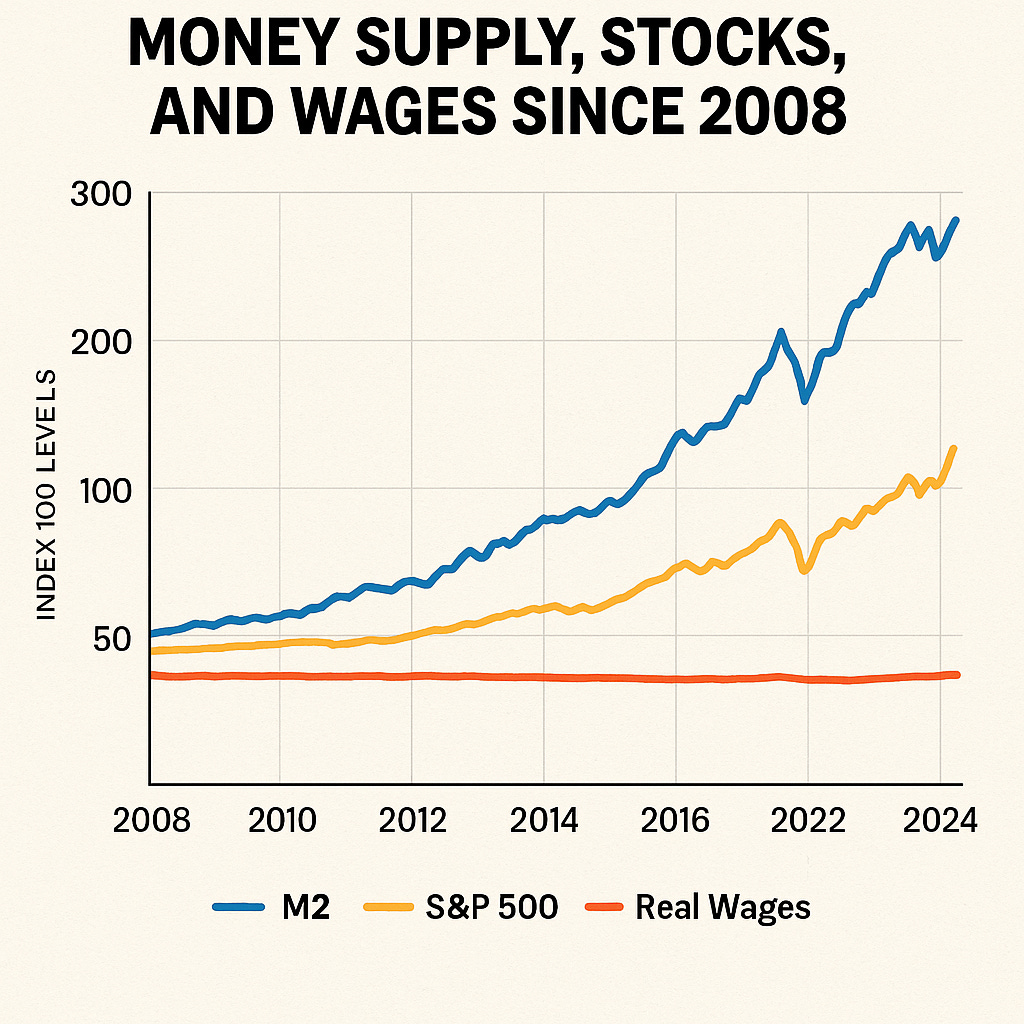

The Cantillon Effect is often described as an abstract theory, but the data is very real.

Wealth Inequality: The top 0.1% of U.S. households now own more wealth than the bottom 90% combined, according to the Federal Reserve’s Distributional Financial Accounts. Each new wave of monetary expansion only widens that gulf.

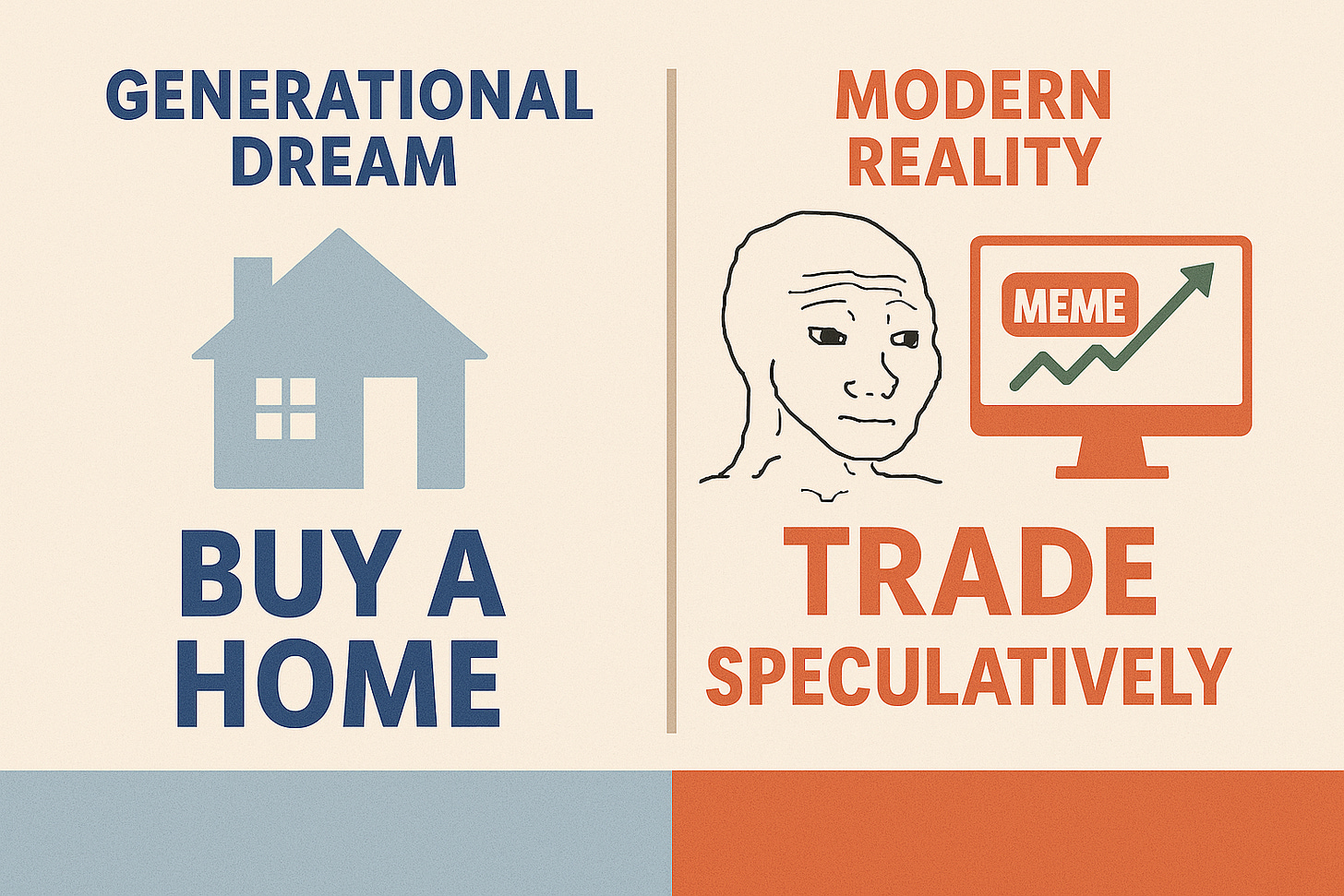

Homeownership Gap: In 1985, Baby Boomers bought homes at roughly 3x their household income. Today, Millennials and Gen Z face ratios closer to 8–10x. This is why younger generations turn to speculation: the ladder has been pulled up.

M2 vs Wages: Since 2008, the money supply (M2) has risen by more than 150%, while real median wages are up less than 10% in the same period. Savers cannot outpace inflation by holding cash.

Meme Market Mania: In 2021, retail traders poured over $22 billion into meme stocks like GameStop and AMC. By mid-2025, similar flows reemerged, with QuiverQuant’s “meme scores” driving billions in capital rotation across dozens of tickers.

The Descent into Financial Nihilism

Once people realize that work, thrift, and saving can’t keep up with asset inflation, they stop playing by the old rules. This is the birth of financial nihilism. It shows up in three ways:

Disillusionment with Work & Savings – Why save dollars that lose value? Why grind when speculation outpaces wages?

Rise of Meme Manias – GameStop, Opendoor, Krispy Kreme, and other meme stocks explode not because of fundamentals, but because retail traders on TikTok or Reddit decide to make them symbols.

Cultural Cynicism – If “the system is rigged,” then gambling feels rational. Nihilism spreads, and speculation replaces investment.

This is what late-stage fiat looks like.

Financial Nihilism Meets Human Psychology

The rise of meme stocks isn’t just economic; it’s psychological. Behavioral finance explains why, when people feel trapped, they swing for the fences:

Prospect Theory: People facing losses or stagnation are more likely to take extreme risks to “catch up.” That’s why trading apps gamified with confetti animations took off so explosively.

Generational Cynicism: When young people see housing and retirement as unattainable, they treat the market as a casino. Meme manias become both a protest and a coping mechanism.

Cultural Parallels: Just as late-stage Rome leaned into “bread and circuses” to distract the masses, today’s system offers speculation as entertainment. When money feels meaningless, spectacle fills the void.

Meme Stocks as Symbols of the Era

In 2025 alone, we’ve watched stocks like GameStop and Opendoor soar 200–300% in days, fueled by nothing more than sentiment engines and retail swarm trading. Platforms now rank stocks by “meme score.” It’s not investing—it’s gambling wrapped in irony.

But underneath the jokes is despair. People sense that serious investing has been locked behind an insider’s wall. If you don’t already own real estate or private equity, the casino is all that’s left. Meme stocks are cultural protest wrapped in ticker symbols.