When the System Cracks, the Mortgage Morphs

How Yesterdays Fannie-Freddie Directive Combines Bitcoin, and Credit, into the Next Great Adaptation of Mortgage Underwriting

“We rarely notice history when it’s happening—we only recognize it once it’s already shaped us.”

Yesterday, something MAJOR happened, and most of the world doesn’t understand why it’s significant.

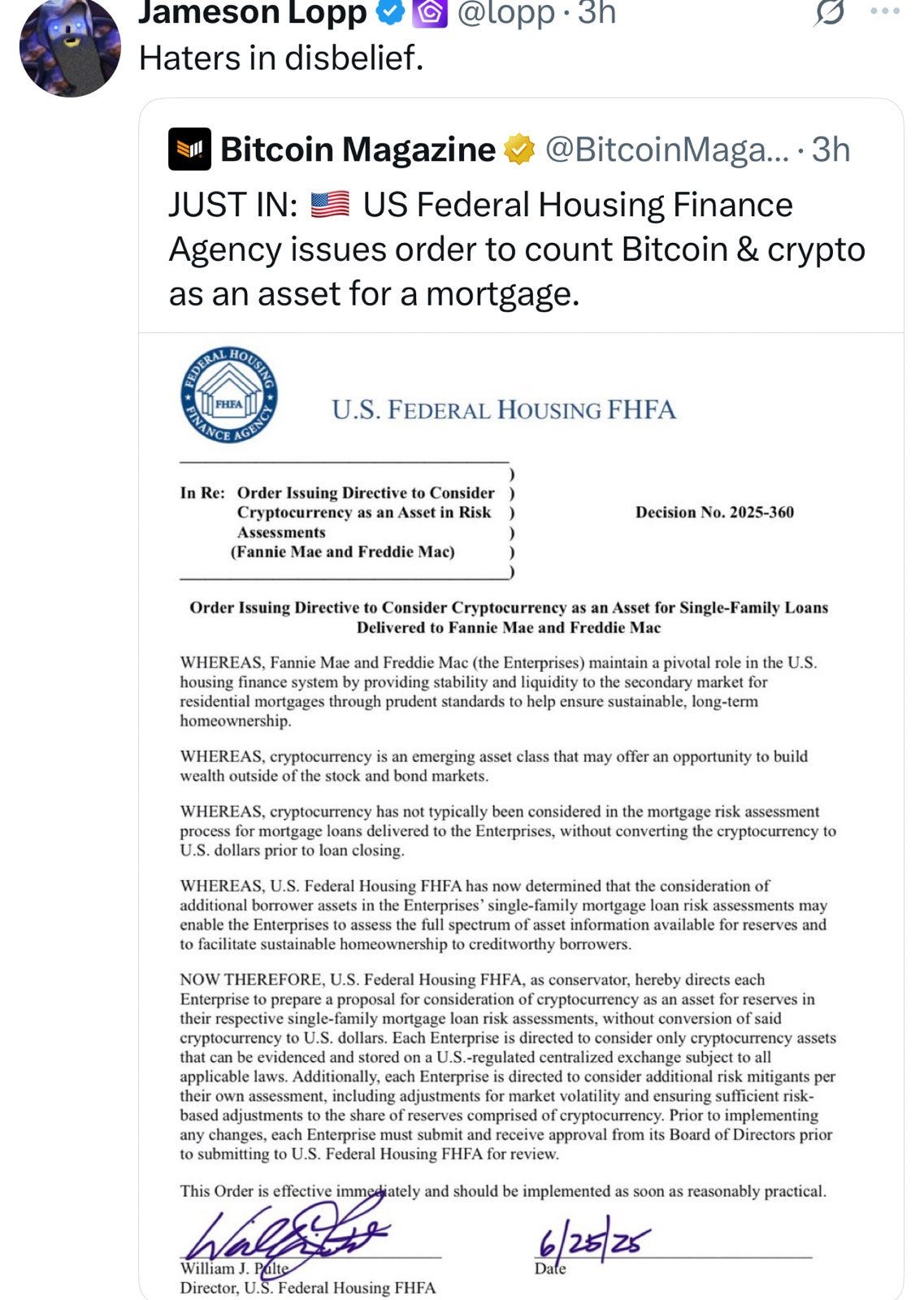

On June 25, 2025, the U.S. Federal Housing Finance Agency Director William J Pulte issued a directive that went mostly unnoticed by mainstream media. Yet in hindsight, it may come to be seen as one of the most pivotal financial policy shifts of this decade.

The directive allows Bitcoin and other cryptocurrencies held in U.S.-regulated custodial accounts to be included in mortgage reserve risk assessments for Fannie Mae and Freddie Mac underwriting.

At first glance, this seems procedural. But for those who understand the historical evolution of mortgage lending, it signals something far more consequential. It represents a break from centuries of monetary tradition and a shift in how trust is measured in the housing credit system.

To understand its true implications, we need to explore where the mortgage came from, how it has evolved in moments of systemic stress, and why this most recent change points to a broader transformation in financial architecture.

The Mortgage as a Reflection of Power

The term “mortgage” originates from the Old French words “mort” (dead) and “gage” (pledge), a “dead pledge” that expires when repaid or upon default. In medieval Europe, mortgages were not vehicles for expanding homeownership. They were tools used by aristocrats and monarchs to access liquidity without relinquishing their land holdings.

“Back in the medieval day”, as they say, the average person didn’t take out a mortgage. They lived or worked on land controlled by those who did.

It wasn’t until the 20th century, particularly in the United States, that the mortgage began to evolve into a vehicle for middle-class wealth-building and social mobility with short terms of 5-10 years with significant downpayments, interest-only payments, and large balloon payments at the end. It then received its first major evolution a few decades later as a response to the housing crisis of the Great Depression.

This transformation did not happen by accident. It occurred in response to systemwide failures and crises that forced policymakers to reinvent how credit and collateral functioned.

Historical Points in Mortgage Finance Evolution

The evolution of mortgage finance has always been reactive. Every major change to its structure, eligibility, or risk assessment has emerged during periods of economic stress, regulatory breakdown, or social upheaval.

^^^^^-Read that paragraph again twice more—^^^^^

Here are a few of the most notable turning points:

1934: The Federal Housing Administration (FHA) was established in the aftermath of the Great Depression to rebuild trust in real estate finance.

1938: Fannie Mae was created to inject secondary market liquidity into the mortgage ecosystem.

1970: Freddie Mac was introduced to expand the market further and support urban lending during stagflation.

1981: Adjustable-rate mortgages were introduced as a response to interest rates exceeding 18 percent, making traditional fixed loans unaffordable.

1997: The mortgage interest deduction was expanded under the Taxpayer Relief Act to boost homeownership as a means of stimulating economic growth.

2008: The mortgage-backed securities crisis revealed systemic risk embedded in opaque tranching and unregulated derivatives.

2025: Bitcoin and crypto holdings were approved as qualifying reserve assets for underwriting purposes, recognizing decentralized digital capital as a legitimate contributor to borrower solvency.

Each of these moments involved more than policy updates; they marked shifts in how capital was measured, trusted, and deployed.

What Yesterday’s FHFA Crypto Directive Enables

The 2025 FHFA directive directs Fannie Mae and Freddie Mac to update their guidelines to include cryptocurrency assets in borrower reserve calculations, provided the assets are:

Held in custody by a U.S.-regulated financial institution;

Valued using adjusted risk models to account for volatility;

Not required to be liquidated or converted into fiat currency before consideration.

In effect, this directive makes room for decentralized capital within the traditionally fiat-only framework of the U.S. housing market. It acknowledges that value can now reside in a financial system that operates outside the direct control of central banks or traditional equity markets.

It also expands the creditworthiness definition to include digital asset stewardship and long-term savings behavior, even when not reflected in traditional W-2 income or brokerage accounts.

A New Kind of Borrower Profile

Consider a (fictional) borrower like Sarah, a 31-year-old self-employed graphic designer who writes a newsletter on Substack to thousands of paying subscribers. Over the past six years, she has saved/accumulated $120,000 in Bitcoin stored in a regulated custody account (or is willing to move it from her self-custody cold storage wallet). Her income is steady but uneven, and she lacks the kind of consistent tax returns that most underwriters prefer. Under traditional mortgage rules, Sarah would be considered too risky—her digital assets were effectively invisible to lenders.

After yesterday, under this new FHFA framework, her Bitcoin holdings can now be counted as part of her mortgage reserve calculation, giving her the ability to access financing options that were previously unavailable.

This isn’t just a financial win for Sarah, it’s a paradigm shift in who gets to be considered “creditworthy.” Multiply her story by tens of thousands of digitally fluent, non-traditional earners, and the directive’s long-term impact becomes clear.

More Than a Policy Change—A Philosophical Shift

This new framework doesn’t just update lending criteria. It reflects a deeper philosophical evolution:

It challenges the assumption that trust in creditworthiness must be rooted in fiat assets or institutional employment.

It introduces the idea that programmable, decentralized assets can play a formal role in legacy finance.

It signals that traditional financial infrastructure is beginning to accommodate the digital economy in more than superficial ways.

Importantly, it creates a regulatory on-ramp for further innovation in the mortgage space—innovation that has already begun elsewhere in the world.

Global Trends Toward Digital Mortgage Finance

The U.S. is not leading this evolution—it is joining it. Across the globe, similar experiments and transitions are well underway.

El Salvador has issued Bitcoin-backed sovereign bonds to fund infrastructure.

The United Arab Emirates and Hong Kong are facilitating real estate transactions through blockchain settlement systems.

China’s mBridge project is piloting programmable mortgage disbursements through its central bank digital currency (CBDC) platform.

What these developments suggest is that mortgage finance is becoming programmable, modular, and multi-asset by design. This trend will accelerate in the years ahead, and the FHFA directive is the United States’ first institutional acknowledgement of that reality.

The Coming Era of Programmable Mortgages

The logical endpoint of these changes is a fully dynamic mortgage system—one that adjusts in real time, interfaces with multiple asset classes, and uses smart contracts for servicing and settlement.

Here is what we’re likely to see:

Mortgages priced and serviced via smart contracts based on borrower performance, not just static terms.

Tokenized property titles that allow fractional equity transfers, global ownership, and seamless refinancing.

Underwriting models are powered by artificial intelligence that factor in both on-chain and traditional financial data.

Real-time loan collateralization based on hybrid asset portfolios, including crypto, equity, real estate, and even intellectual property.

These innovations are not speculative; they are already being tested in fintech sandboxes around the world.

Inclusion, Risk, and Ethical Questions

It’s important to recognize that this shift also brings new risks and concerns.

There is a real possibility that:

Centralized crypto custody could increase surveillance of borrower assets.

Excluding self-custodied crypto may marginalize sovereign asset holders.

Automated lending could introduce algorithmic bias or unintended liquidations.

However, these risks are not arguments against innovation. They are challenges to be addressed through thoughtful governance, ethical design, and regulatory clarity.

What we cannot do is cling to outdated systems simply because the new ones are still imperfect. Financial progress has always been iterative. What matters is who builds the rails and how inclusive, resilient, and secure they are.

The Mortgage as a Macro Indicator

The mortgage has always been more than just a product. It is one of the most sensitive indicators of systemic health.

Rising originations suggest economic expansion and confidence.

Declining originations, approvals, or increasing defaults point to underlying fragility. (What we are seeing today)

Structural changes in underwriting criteria reflect changing definitions of value, risk, and trust.